- #QUICKEN 2015 HOME AND BUSINESS BEST PRICE PRO#

- #QUICKEN 2015 HOME AND BUSINESS BEST PRICE SOFTWARE#

- #QUICKEN 2015 HOME AND BUSINESS BEST PRICE PLUS#

- #QUICKEN 2015 HOME AND BUSINESS BEST PRICE FREE#

- #QUICKEN 2015 HOME AND BUSINESS BEST PRICE WINDOWS#

That, and the eventual downsizing of housing in retirement to cash out excess equity, are the only ways I see my home benefiting my net worth.

#QUICKEN 2015 HOME AND BUSINESS BEST PRICE FREE#

I’m more concerned with paying off the mortgage to free up my income to increase my investable net worth.

In my case, most of the equity I’ve built up in the house will just go into the next home I purchase, so the house doesn’t really mean much to my net worth because I’ll always need somewhere to live. I consider improvements to the house as expenses, although I’d feel differently about a $50K improvement. I may change it in the future if I have evidence that the house would sell for significantly more or less than that price. However, I simply use the home’s appraised value from when I purchased it 2 years ago.

#QUICKEN 2015 HOME AND BUSINESS BEST PRICE SOFTWARE#

I use MS Money 2004 and I have an asset account for my home so I can track my mortgage without the software telling me I have a negative net worth. Not that I actually do that myself, but that is as reliable a method as I can see for doing it. I recommend using some weighted average of 2, 3, and 4 (and, if you are or are married to a real estate broker, #1), adding 90% of the cost of home improvements (not repairs), and then multiplying by 94% (to reflect a 6% sales commission).

#QUICKEN 2015 HOME AND BUSINESS BEST PRICE PLUS#

There are a few sources of value estimates to use:ġ) a local real estate broker (but if you ask often they’ll try and convince you to sell churning your home is not recommended)Ģ) an estimation site like zillow (of unknown reliability their estimate on my house in a major city increased more than 10% inexplicably during January 2008)ģ) tax assessors office (can be a very lagging statistic here they always use the value as of January of the prior year – so January 20 tax bills).ĥ) your insurance company’s estimate of replacement cost, plus the tax assessed value of the land.ĥ) your own knowledge of improvements (but most improvements don’t return 100% at sale). But they aren’t high liquid (nobody is making a market in your home), so determining a value is iffy. The Quicken Rental Property Manager costs $119.99.To get an accurate picture of net worth, you should include major assets like a home.

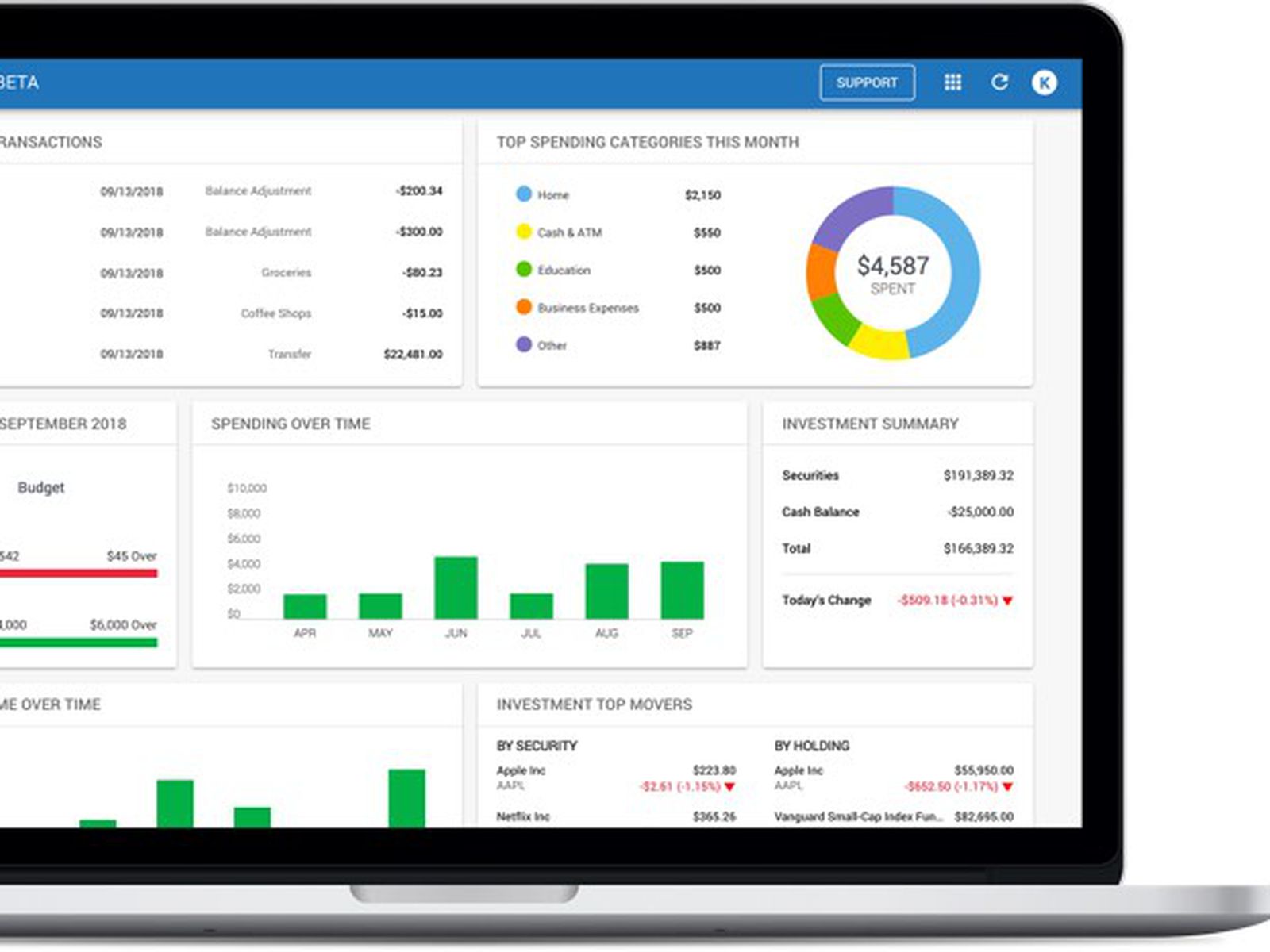

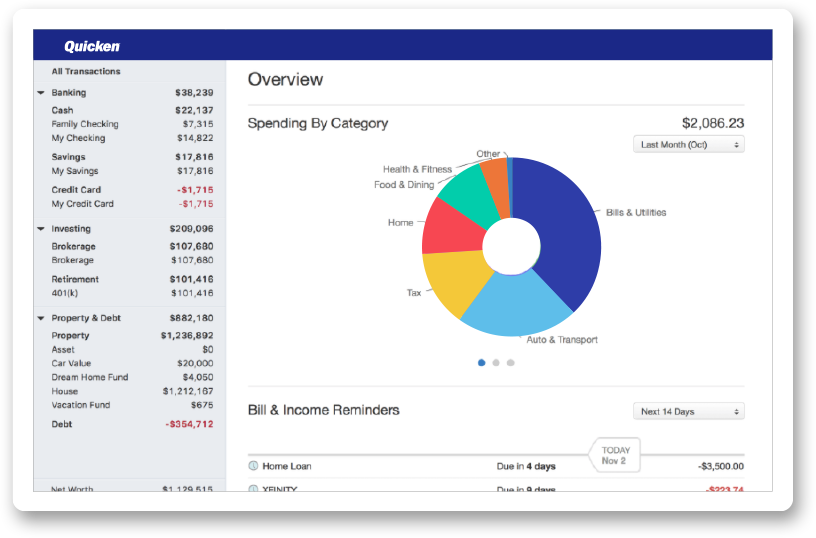

Quicken Essentials costs $39.99, while Quicken Deluxe costs $49.99, Quicken Premier costs $69.99, and Quicken Home & Business costs $79.99. Quickbooks Enterprise solutions cost $480 per user.

#QUICKEN 2015 HOME AND BUSINESS BEST PRICE PRO#

Quickbooks Pro costs $183.96, while Quicbooks Premier costs $319.96. Quicken is mainly used by customers in North America, but localized versions are available in Australia, Germany, Hong Kong, India, New Zealand, the Philippines and Singapore. Quickbooks is adapted for use in the US, Canada, the UK, Australia, New Zealand and Singapore.

#QUICKEN 2015 HOME AND BUSINESS BEST PRICE WINDOWS#

Quicken is compatible with both Macs and Windows PCs, and also has an online version. A Mac-compatible version is available in the US only. Quickbooks is compatible with Windows PCs. Quicken allows the user to maintain an inventory of household possessions, for use in emergencies such as fire. Quicken, on the other hand, allows the user to track the cost basis and current market value of stocks, bonds and mutual funds.

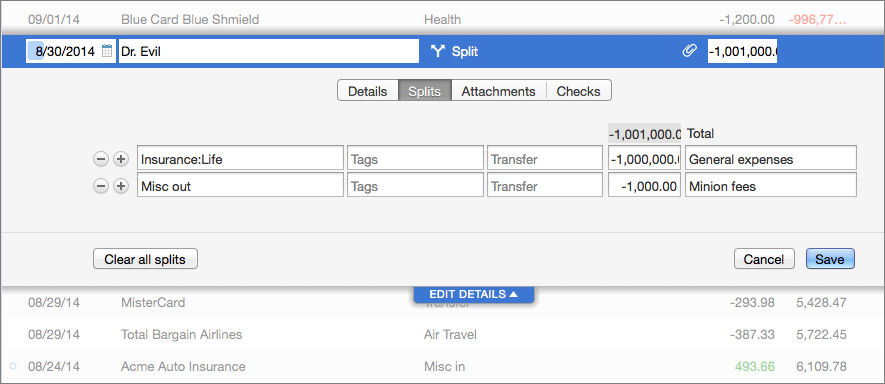

Quickbooks does not allow the user to track investments. Quicken does not have any of these features. It can integrate with Word, Excel and Outlook and can handle multiple users. Quickbooks allows the user to develop a business plan, track business sales tax, track sales invoices and inventories, manage payrolls and track expenses. However, only Quickbooks is able to monitor unpaid invoices. Quicken has 401k-vs-Roth-401k|retirement planning]] built into its software.īoth Quickbooks and Quicken allow the user to find tax deductions.īoth Quickbooks and Quicken allow the user to create invoices. Quickbooks, as a small business finance program, does not help the user to plan for retirement. US, Canada, UK, Australia, New Zealand, Singapore.ĭesigned for US, Canada, Australia, Germany, Hong Kong, India, New Zealand, the Philippines and Singapore.īoth Quickbooks and Quicken allow the user to create budget reports and graphs.īoth Quickbooks and Quicken allow the user to pay bills and make transfers online. Quicken New User, Quicken Basic, Quicken deluxe, Quicken Rental Property Manager, Quicken Premier, Quicken Home and Business, Quicken Personal, and Quicken Personal Plus. Quickbooks Pro, Quickbooks Premier, Quickbooks Enterprise Solutions

0 kommentar(er)

0 kommentar(er)